Helen Luketic, CHRP

Good or bad economy, the need to make a quality hire doesn’t change. Given that the Cost of Voluntary Turnover for 2009 was approximately $56,000 for the private sector and over $80,000 for the public sector, hiring decisions cannot be taken lightly as the wrong decision can impact the bottom-line.

Good or bad economy, the need to make a quality hire doesn’t change. Given that the Cost of Voluntary Turnover for 2009 was approximately $56,000 for the private sector and over $80,000 for the public sector, hiring decisions cannot be taken lightly as the wrong decision can impact the bottom-line.

How can you assess whether or not your organization makes “quality” hires? There are simple metrics you can start collecting. Once you start tracking these basic four metrics, you can drill down further to identify the success stories or true issues.

Let’s start at the very beginning

There seems to be constant angst over how HR can truly measure the quality of a hire as there are so many factors that can influence the hiring decision. Then there is the debate of who is responsible for the quality of hire – HR or the hiring manager. It’s ultimately HR’s responsibility to set the hiring manager up for success, and advise them using their influence and expertise. Further, it’s HR’s responsibility to monitor its human capital and advise the organization on the best course of action, based on sound data.

Now that we’ve established that HR is responsible for quality-control, let’s start measuring quality. There are several ways to do this but the most efficient and informative way is to measure the Resignation Rate and Involuntary Turnover Rate.

Buyer’s remorse

The goal of an effective hiring process is to hire someone who is productive and adds to the bottom line. During the recruitment process, the organization is selling itself to a candidate and a candidate is selling itself as the best choice for a hire. Should either side misrepresent, someone could end up with buyer’s remorse.

First, let’s focus on the organization as the “buyer”. The hiring decision is an investment for the organization. For this investment to be made, the expectation is that the new hire will be fully productive anywhere from 90 days to a year from the date of hire, depending on the job level. What happens when the hire doesn’t perform at the minimum level within a reasonable timeline? The assumption is that non-performing hires will be involuntarily terminated by the 90 day or 1 year mark. Therefore, an organization should assess their buying decision and their decision making process with: 90 Day Involuntary Turnover Rate and 1st Year Involuntary Turnover Rate.

Next, when a new accepts a job offer, they are the “buyer”. To attract the best candidates, organizations create a brand for themselves to sell their product: their culture, team and job. If there is a mismatch between the job that was sold and what was ultimately offered, the new hire may have buyer’s remorse. If the new hire was sold a bill of goods and the organization didn’t deliver, chances are they will leave. (miedemaproduce.com For the most part, new hires will leave anywhere within 90 days (if it’s easy for them to jump ship and find a job elsewhere), all the way up to a year. Therefore, an organization should assess their recruitment process with the metrics: 90 Day Voluntary Turnover Rate, 1st Year Resignation Rate.

These metrics will alert you to a problem if there is one but you haven’t yet pinpointed the core issues. From here, dig further into the information around you to identify the problem.

The next steps

How do you know if you truly have a “problem” or if what the numbers aren’t worth sweating over?

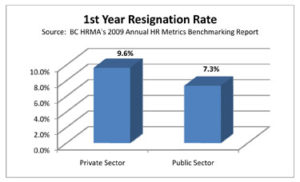

Track these four key metrics figures at least quarterly to identify patterns. Is the rate of resignations steadily increasing over time? This may be a good time to look at external benchmarks and assess what is “normal” for your industry or sector. A little tip: In 2009, the 1st year Resignation Rate for the public sector was 24 per cent higher than the private sector:

If you think there may be hiring quality issues, dig for information on why the hire didn’t work out. What are the patterns? Are you seeing the involuntary turnover or resignations:

- in one particular department?

- with a particular manager?

- during a particular time of year?

- in a particular job role?

- in a particular age group?

Other questions you should consider asking include: did that hire attend any training, including an orientation? What were the sources of the bad hires? Did the poor quality hires consistently have a different education level or work experience than successful hires?

Keep digging up until the point that the answer is crystal clear.

Finally, consider adding qualitative data to your story. Onboarding surveys are a great way to assess the new hire experience; exit surveys are an excellent way to ask resigning employees about their experience and why they are leaving.

It’s easy, it just takes time and guts

Measuring your quality of hire ultimately isn’t difficult. The majority of organizations can report on resignation and involuntary turnover rates fairly easily, most organizations already do exit surveys and benchmarking data is readily available. The difficulty in measuring quality of hire is in HR accepting the accountability for a quality hiring process, carving out the resources to monitor quality, and being comfortable using data to make recommendations.

About the Author:

Helen Luketic, CHRP, is the manager of HR Metrics & Research at BC HRMA. She is the winner of the 2007/2008 Rising Star award for her significant contribution to the developing field of HR measurement. Helen is focused on sharing this knowledge with BC HRMA members through workshops, articles and the HR Metrics Service. Check out her blog at http://hrblogatresearchvoice.wordpress.com.

Reprinted with Permission from BCHRMA

Related to How to Measure the Quality of Hire:

- Employee turnover – how much is it costing you?

- Turning around turnover – how to keep the best employees

- New hire training: paving the way for new staff

- Exit interviews: don’t just say goodbye